Mary Meeker 2018 top picks

Rafael Adrian Müllener Cifuentes

Partner & Chief Commercial Officer

It’s that time of year again, you can almost smell it can’t you… Yup, the Mary Meeker report is back, to shed some light on the past, present and future of digital.

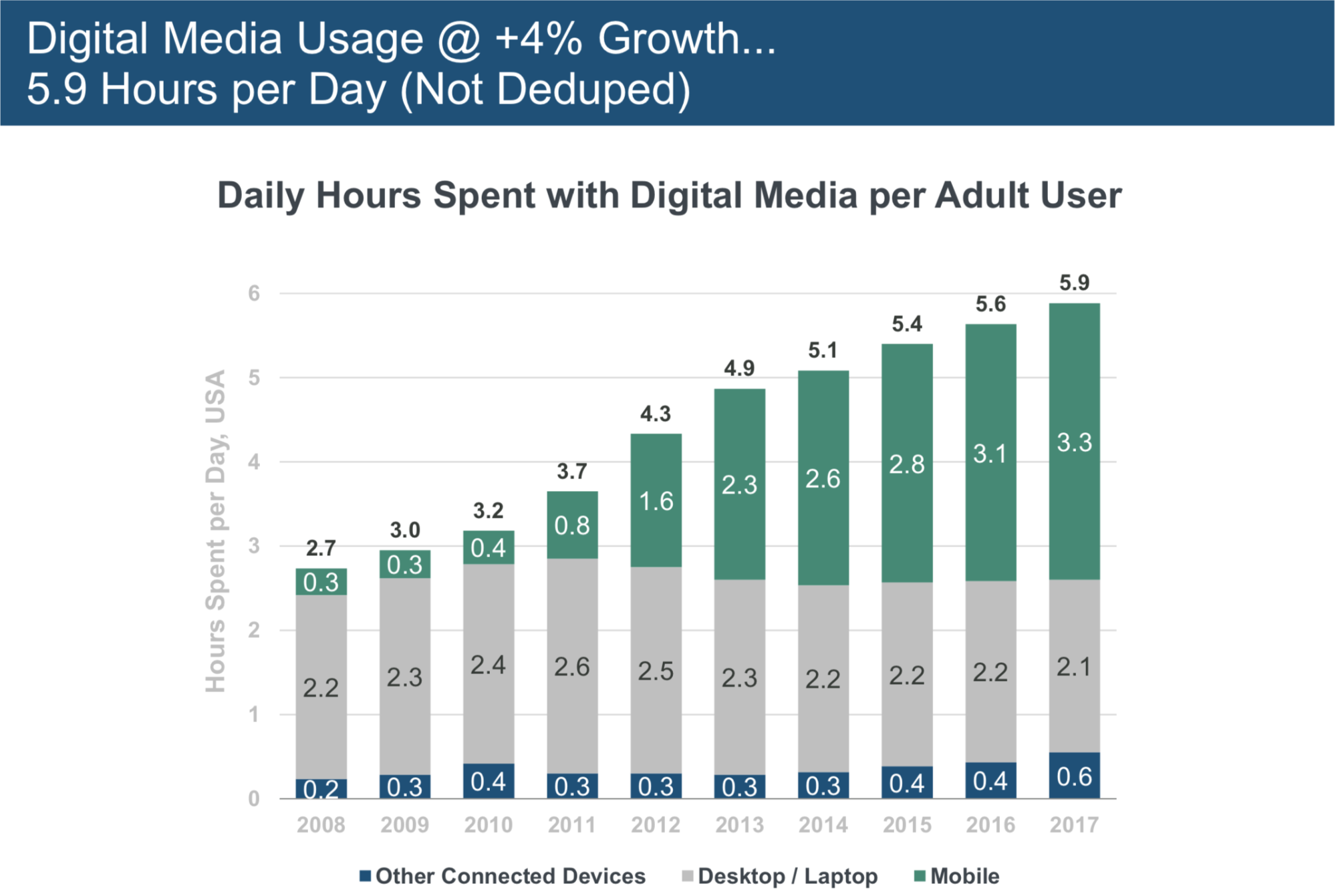

The number of mobile devices is not necessarily increasing, but the time we spend on our phones is. We continue to consume more digital media — at the cost of other activities (rumoured to be e.g. sleeping), and added 30 minutes daily (Year/on/Year) in digital media usage driven primarily by mobile — in itself quite an astonishing number.

It’s worth looking at the two giants of the digital advertising industry, Google and Facebook, and their latest 2018 Q1 earnings calls: Paid ad clicks on Google’s own sites and apps (they include video ad views that technically aren’t “clicks”) rose 59% annually, outpacing Q4’s 48% growth. This more than offset a 19% drop in cost per click (slightly worse than Q4’s 16% drop), the consequence of mobile search and YouTube ad prices being lower on average than desktop search ad prices. Perhaps the reason for this could be that advertisers still lack the foundation for assessing the true value of mobile advertising and YouTube, which are both channels where more elaborate analysis and tracking skills are needed. It is likely that many advertisers still struggle to perform proper cross-device analysis work and attribution modeling. Thus keeping their investments where the simplest of tracking and measurement still lies: the last non-direct click attribution that is default in most measurement platforms.

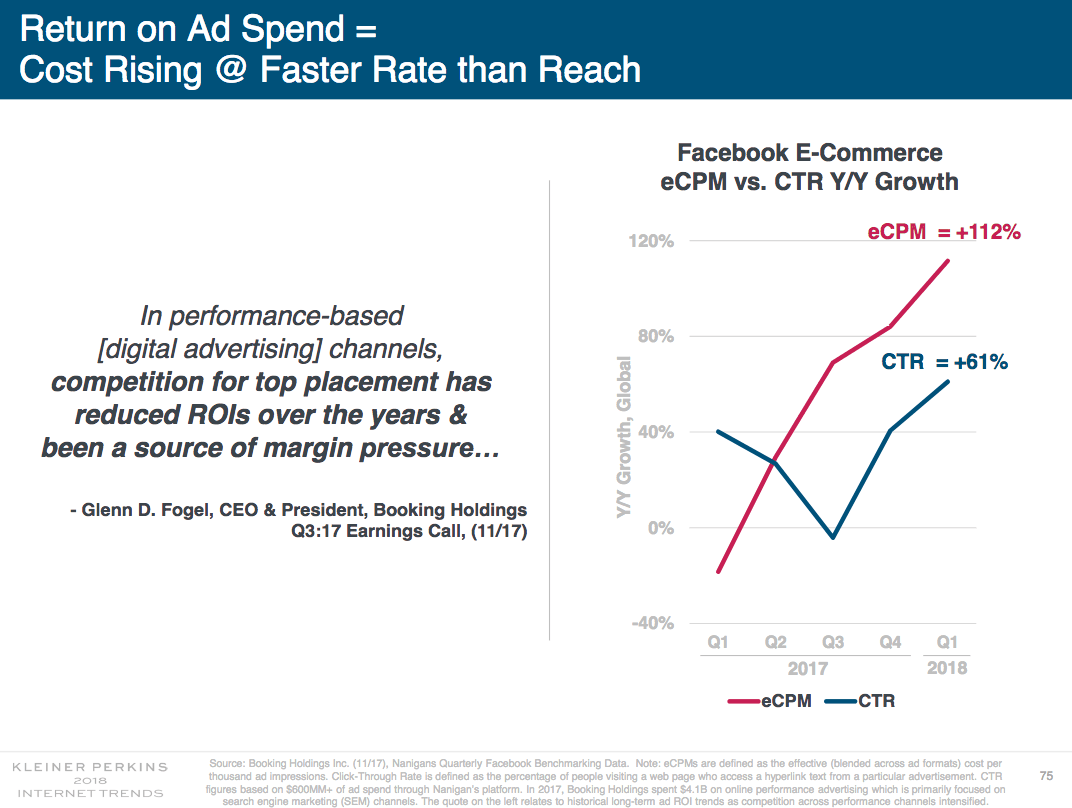

Facebook is as everyone else becoming even more dependent on mobile as mobile advertising revenues represented approximately 91% of advertising revenue for the first quarter of 2018, up from approximately 85% of advertising revenue in the first quarter of 2017. Interestingly, Facebook is reportedly seeing increasing engagement with its ads and thus the cost of impressions is rising faster than their reach.

Looking to the East

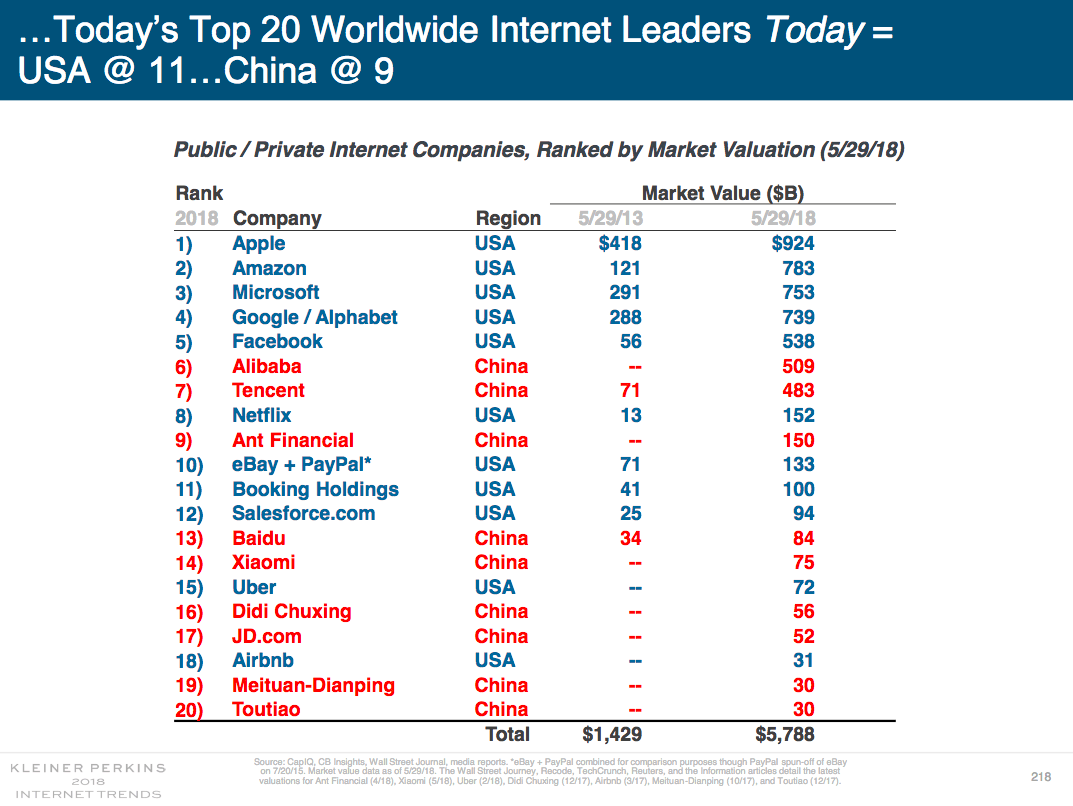

China is done with playing catch-up; from having 2 companies among the top 20 leading internet companies 5 years ago, that number is now 9(!). Out of those 9 companies only two even existed 5 years ago.

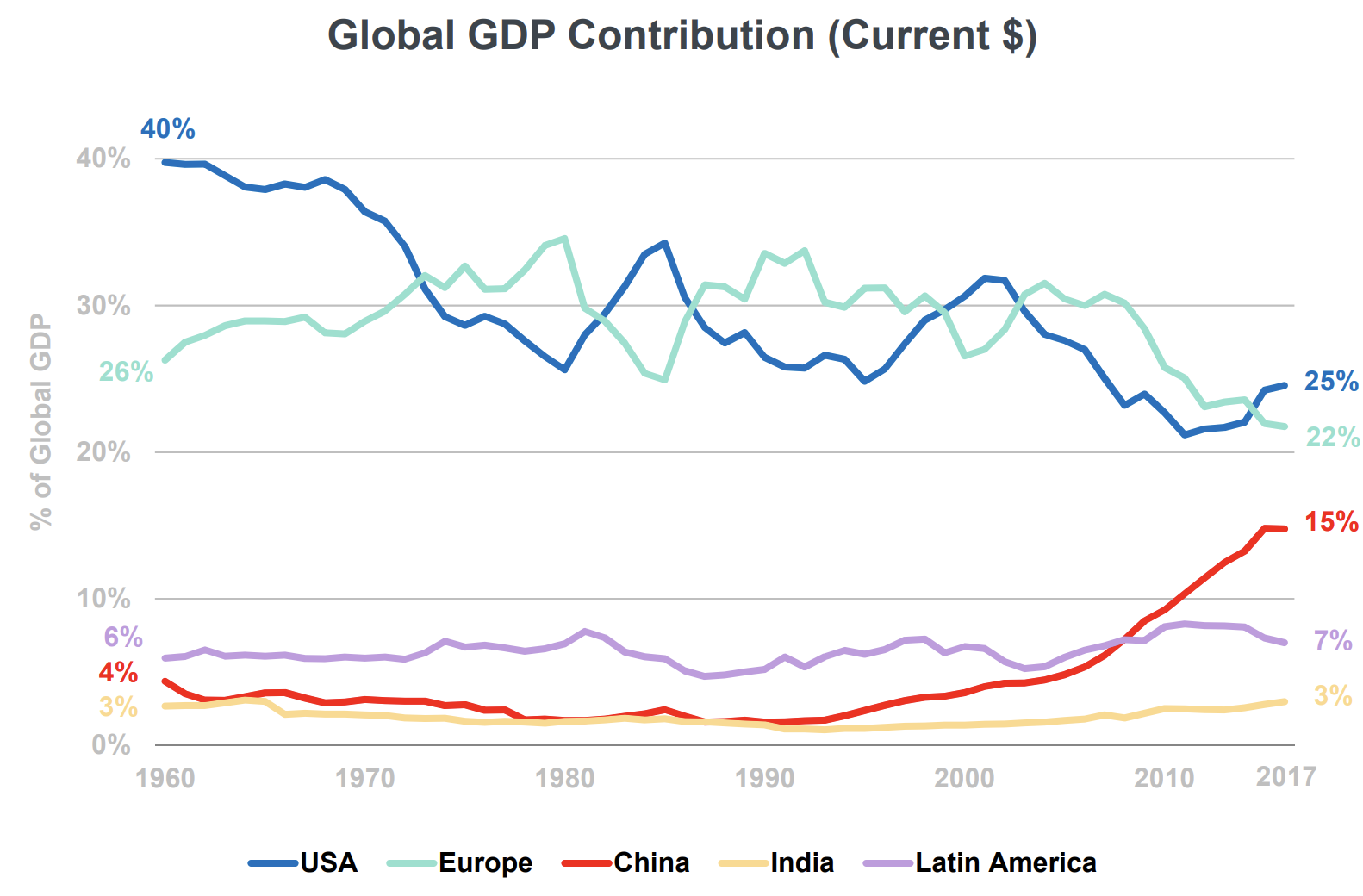

Aggressive investments, exceptional growth rates for GDP, mobile shipments, ecommerce and a strong emphasis on educating its workforce has put China in pole position in the tech race going forward.

Adding to China’s advantageous position in the market is an increased expectation for personalized experiences. Delivering curated online experiences is contingent on both tech stacks and, obviously, the foundation of personalization: user data. This year, both the European Union and Japan passed legislation to increase the privacy protection of its citizens. While we have also seen increasing political pressure in the US for stricter privacy laws, it is a somewhat different story in China: Compared to the global index, Chinese consumers are 40 % more willing to share data for benefits which enables companies to gather, share and use more data in apps they build and services they provide.

Compared to the global index, Chinese consumers are 40 % more willing to share data for benefits which enables companies to gather, share and use more data in apps they build and services they provide.

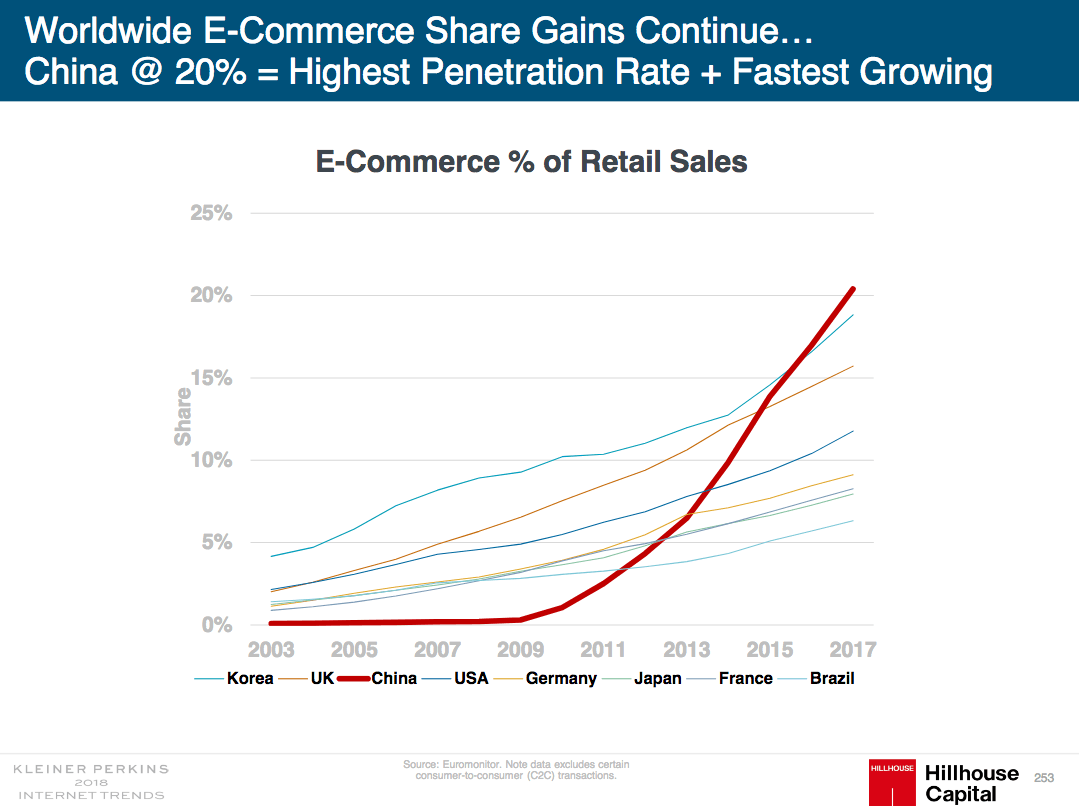

With talent, consumers and legislations aligned, China is like the place to turn to for a glimpse of the future of tech and E-commerce. Looking at their astonishing growth rate and global leadership in E-Commerce sales in the retail category (E-Commerce accounts for 20% of all retail in China), China will likely be the driver of many of the biggest innovations within E-Commerce.

The Rise of the Machines

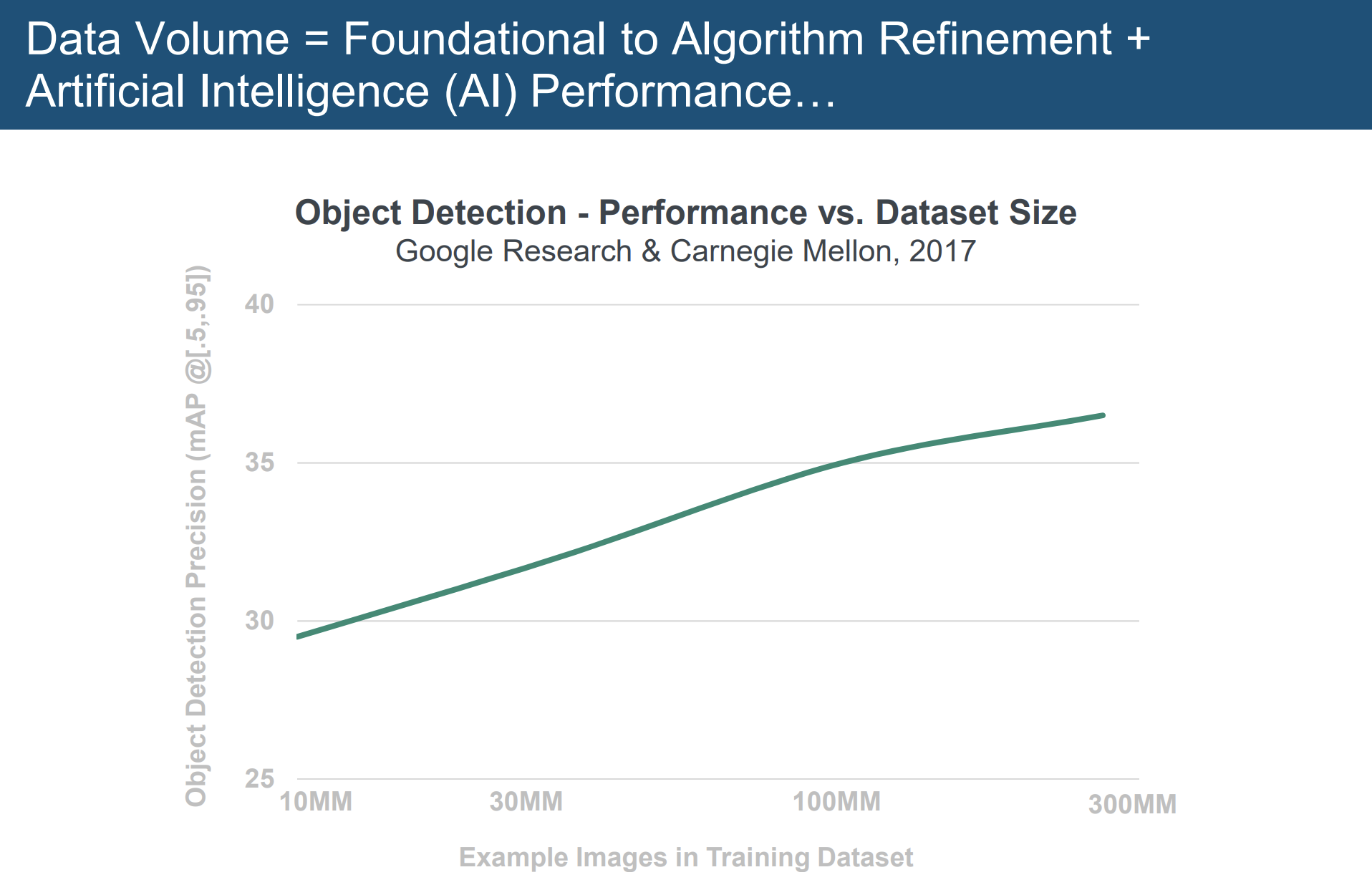

Artificial Intelligence is believed by many to be the most impactful innovation of our time. But one of the biggest challenges seems to remain year after year; gathering large enough datasets for intelligent applications to train with and ultimately make the right decision(s) for. An example presented in the report from Google and Carnegie Mellon illustrates the correlation between data volume and performance for one of their applications, indicating the demand of vast amounts of data.

Digital marketing has from its dawn been blessed with large and structured datasets and the platforms like Google, Facebook, etc. have left it to its advertisers to be creative in how they utilize it. The level of sophistication on how to use the data have been rising ever since and today all marketers, knowingly or not, uses AI applications to some extent. With that in mind a bigger question presents itself; how will AI transform the role of digital marketers?

One trend on that topic worth noticing is how Google and Facebook are presenting more and more smart applications to its users; bidding tools, ad optimizers, etc. Hence switching from a data provider to a solutions provider. The motives behind that are many; the need for data to push performance goes beyond single accounts, user data is more sensible and they want to increase their say in how their users spend and evaluate their investments on the platforms. The last point is perhaps the most interesting for our question. Any given marketing platform (as long as there is competition) will only train on a subset of the data that is their customer’s reality, which is like trying to draw a map of the world with only knowledge of one country. Hence it will be up to the marketers to lay the puzzle of how data should be shared and value attributed between platforms.

Building on that it will likely be increasingly important for marketers to make sure that the smart applications they use work towards the right goals. In other words Google won’t know how you define business value unless you tell it. Even though the vertical integration initiatives such as Google and Salesforce’s partnership and Microsoft acquiring LinkedIn, marketers still have their job cut out for them in aligning internal stakeholders on what business value to drive with marketing and to make those data points available from the internal system to the marketing tools.

Besides an increased focus on uncovering the true value and attributing credit and information to the channels that drives it, learnings from the transition from analogue to digital marketing still holds true; adopt and test new tools and practices fast and you can secure a competitive edge.

Times are exciting.