Shopping launch in Finland – what have we learned so far

Juuso Petteri Rantanen

Digital Specialist

After a long wait and a few months of testing, Google Shopping was finally fully launched in Finland in September 2019. At Precis we had already gathered years of knowledge on running Shopping campaigns worldwide, giving us the advantage to be the fore-runners in Finland and using this knowledge in setting up the campaigns for Shopping. A few months have now passed since the launch, so it’s time to put together some learnings from running Google Shopping campaigns in Finland.

Early Development

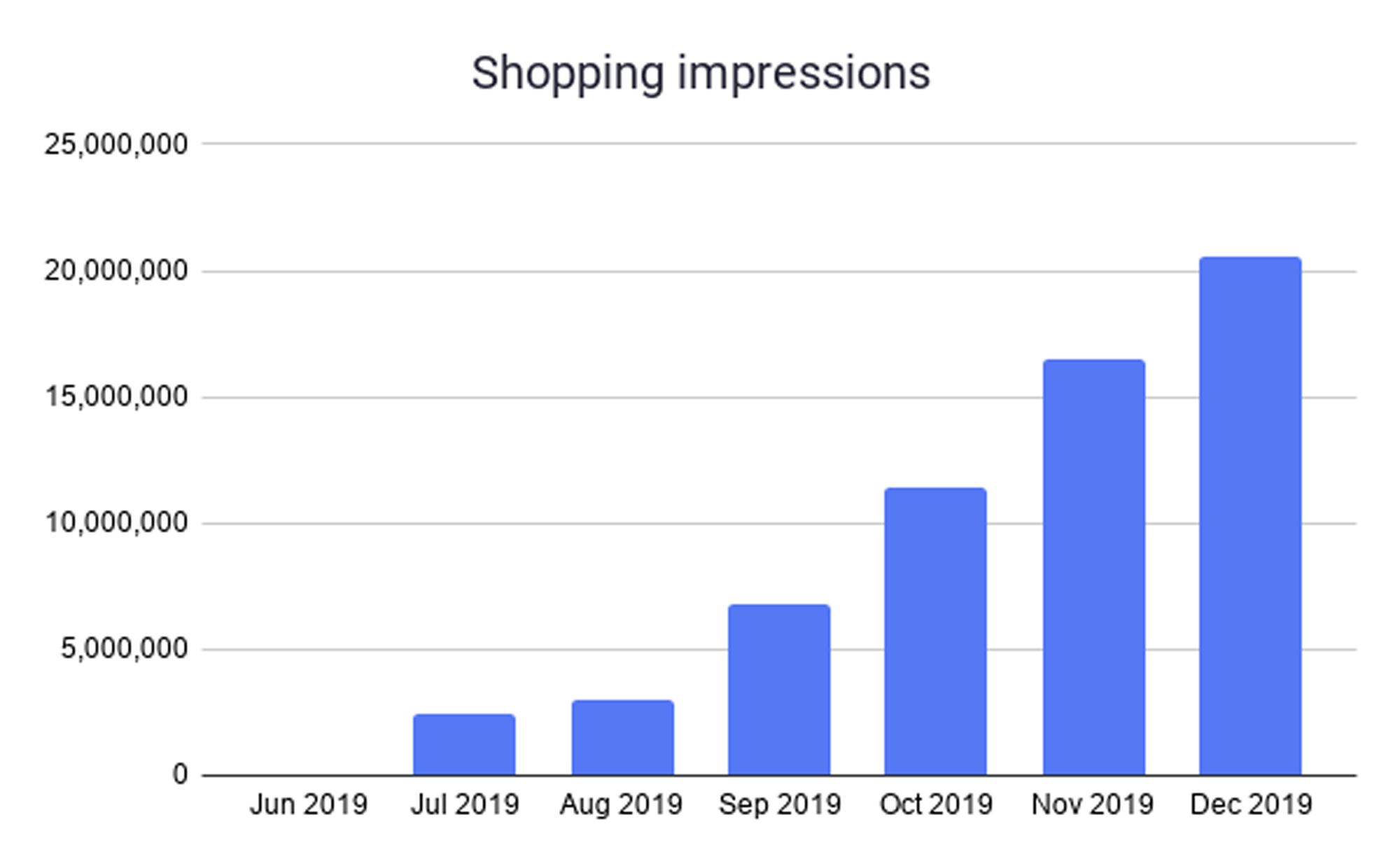

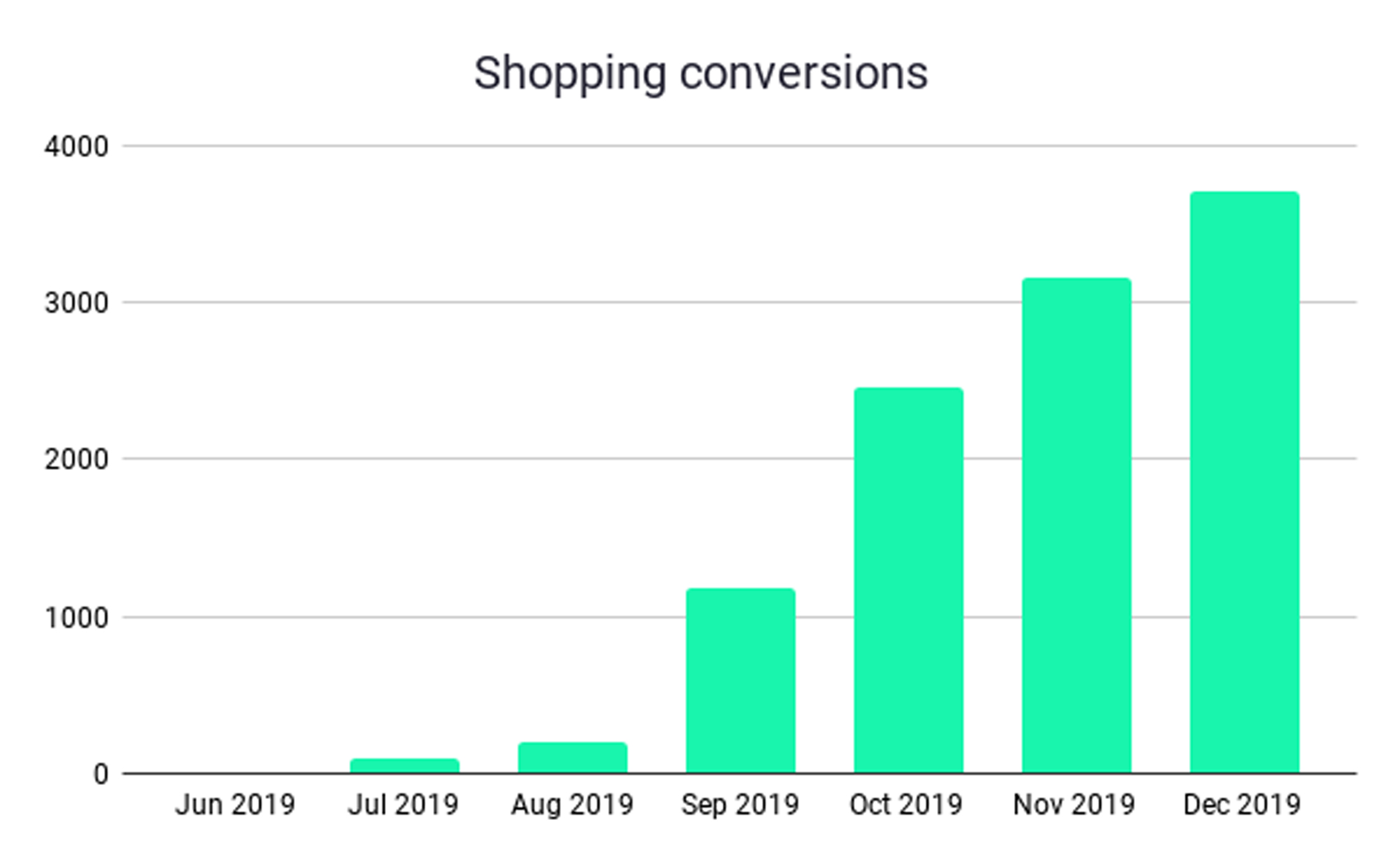

Google Shopping campaigns started to first get impressions during the testing period between June – August 2019. Since the full launch we have seen continuous increase in terms of traffic and conversions coming from Google Shopping campaigns.

As impressions have grown over the months, conversions have followed at a similar rate. In some of our accounts we have yet to reach the conversion levels of traditional generic text-based search campaigns, but the shift is likely to happen soon. This has been the development in other markets during the previous years and we fully expect Finland as a market to follow the same trend. What this also implies, is that we need to move more of our resources from text-based search ads to optimizing Shopping campaigns.

Obviously it’s hard to make any conclusions yet considering the season Shopping was launched. Since many of our clients are retailers, with their peak period lasting between November (Black Friday) and December, we are eager to see how the development of Google Shopping in Finland will look in a few months.That being said, the increasing trend is of course an indicator that Shopping ads will take its place next to text-based search ads also in Finland.

At Precis we were definitely ready for the Shopping launch, and managed to pick-up traffic and conversions from day one. During the last months we have seen a small decrease in search impressions shares, suggesting that the competition in this new ad placement is indeed increasing. As the market for new ad placement matures in Finland, we expect the volumes to rise, but also competition to increase. This leads us to the next learning, the importance of optimization…

Optimisation

Title optimisation

Yep, you’ve already read it everywhere: title optimization is one of the best ways to increase both the search query eligibility and volume, as the title is one of the main sources of information for Google to match products to what people are searching. This has definitely come to realization in the Finnish market, for so far we have seen a big chunk of the traffic in Shopping coming from branded search terms whereas in other markets a big share is coming also from the generic search terms. Clearly there is still a lot to gain from more generic searches, and title optimization and testing are always very high in our priority list.

Depending on the product category, users tend to search products in different ways. To get optimal results, one needs to analyze the specific ways users are searching products on their portfolio, all the way to the optimal order of the words in the title. Google has come up with suggestions for optimal titles in many product categories. But as we know, Finnish language has somewhat tricky grammar so that might be something you need to pay even more attention than in the other markets.

Also, due to the fact that Google Shopping has just been launched in Finland, it might be that feed optimization is even more important than in more mature markets. The more data Google gets, the better its machine learning algorithm does in mapping the GTINs and search queries together. In more established markets Google already has a lot more data to understand which GTINs more often convert to which search queries, so it will favour more those products thus making title optimization a little less relevant.

To get most out of your product data, one useful method is to triangulate the data in the product feed, using the same generic terms in more than two data points of the product. This way important search terms can be emphasized and make products eligible for more search queries. Here at Precis we often use supplemental feeds to accomplish strategies like triangulation of the data, in addition to many other tasks.

Campaign Structure & Bidding

Recently we shed a light on our thoughts on Shopping strategy and how the smart bidding should be taken into account when defining overall campaign structure. At Precis we often take advantage of using campaign priority levels, combined to some other product-related information which is filtered by inventory filters in the settings. One classic example would be to divide campaigns based on the product category, in addition to priority-level based on price point or profit-level inside that category.

Analyzing the data gathered from Google Shopping can reveal interesting insights and affect the campaign structure strategy. There have been studies which show that only every third Shopping converter ends up buying the product they initially clicked. One of our internal studies showed that up to 71.6% of converters ended up buying the product they also initially clicked.

Depending on what the data shows, one can end up building completely different campaign structures. Considering if the conversions will spread across the product range, a campaign structure can be built around price-competitiveness or best-seller products, even if those products have lower margins. The assumption then would be that cheaper or very popular items might be able to create higher CTRs and/or increased traffic and open opportunities to cross-sell or upsell products on the website.

On the contrary, if data shows that people actually buy what they click, one might go for a more profit-based campaign structure. We highly recommend building your own studies to actually understand what people end up buying from Google Shopping.

Precis CSS

Precis was one of the first local agencies in Finland to provide Comparison Shopping Service (CSS) in the market. Merchants who advertise products through CSS instead of Google can get up to 20 percent CPC reductions, depending on the auction in place. You can read more about the possible outcomes here.

Our CSS service has full transparency on spend match and reduced CPC levels. All the CSS activities are run through clients’ Google Ads account, and of course with full access to CSS Merchant Centre.

Moving on…

We have not yet reached the level of generic search ads with conversions, but in many accounts Shopping campaigns will likely soon take over as the main driver for conversions apart from brand search. What this means for us at the Precis Helsinki office is to gather more knowledge and more resources for Google Shopping to define relevant strategies for our clients.

Google has also launched Showcase Shopping ads, where you can tie together related products for one ad. This is a great way to excel in a category or other more generic searches since it is possible to showcase more than one item per ad. Unfortunately, Showcase Shopping ad type has not yet launched in Finland, but as with other ad types, we have already gathered knowledge on these from other markets where Showcase ads are available.